Choosing Between Chargebee and Stripe: Which Is Right for...

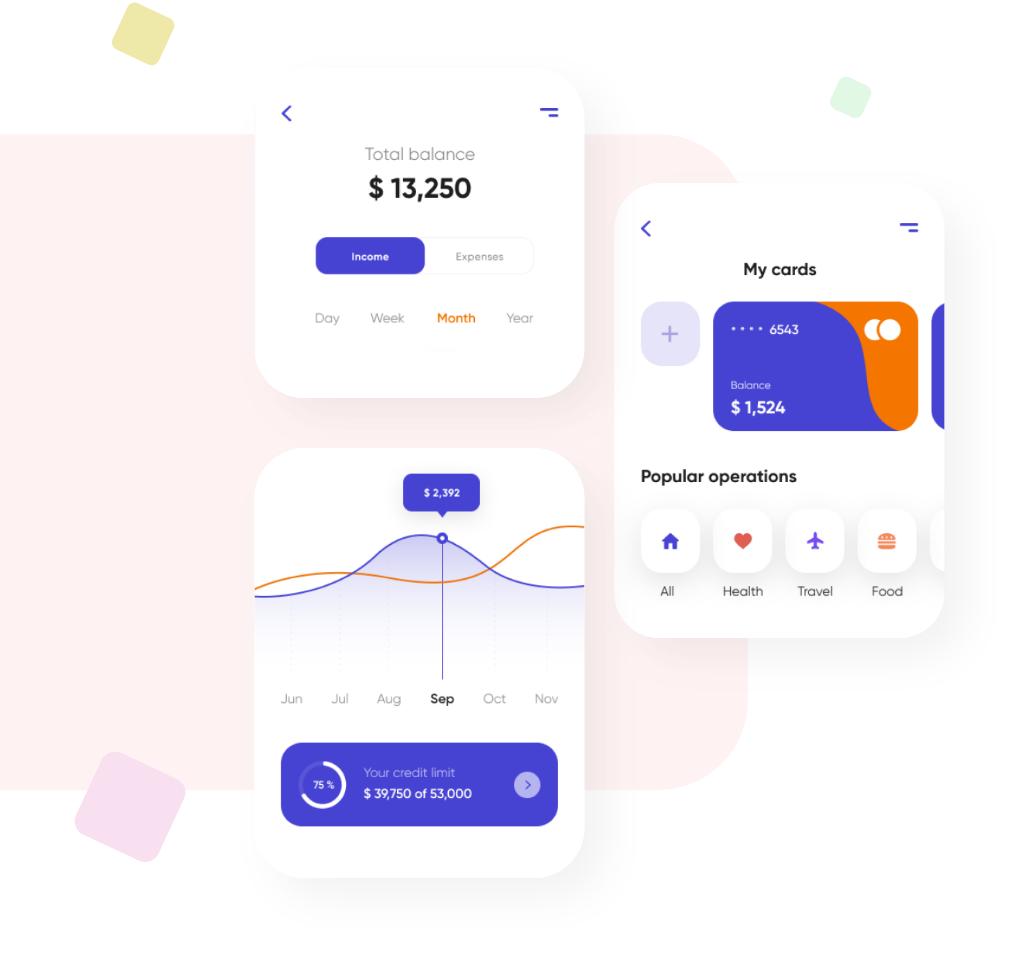

Read MoreAutomate your accounting and leverage the single source of truth for all financial and performance data analytics you need to run your SaaS. SAIF has all the complexities of SaaS metrics, accounting and reporting built right in.

Close to 4500+ SaaS finance professionals changed their Jobs in last year only. Our tool will document all the related processes for each SaaS to store and modify. All the resources such as Customer and vendor Invoices, agreement, ledgers are stored within the tool and in due custody of the company.

Typical outsourced CA firm or a low experience and cost In-house team lacks SaaS Finance management skill set resulting in Incorrect Financial reporting impacted Business at large. SAIF has built in combined experience of 100+ years managing SaaS finance and specifically curated for SME SaaS business

Not monetising new-age Finance management tools due to lack of skill set and resulting in inefficient and incorrect Finance management. SAIF leverages the latest technologies around automation and AI to facilitate error free and efficient finance management.

Not closing numbers on time and waiting for an Investor/Founder request to prepare SaaS metrics and financials is not healthy for any SaaS. Timely Month close is important to avoid the inevitable mistakes. With SAIF’s automated Financial Preparations and state-of-the-art month close process, action insights can be self sourced and let the numbers do the talking without waiting for Investors/Founders to point it out at a later stage.

No control over Historical records, every time when a customer/vendor/investor ask for it, need to dig it down from various sources and sometimes it's not even obtained/prepared at the first place SAIF’s contract and regulatory management feature is so seamless and structured that it allows/facilitates the authorised user to access all historical records in one place. Our transition management team ensures and advises on the most important documentation management.

SaaS businesses, as they grow, find it difficult to scale their Outsourced CA Firm or any In-house team’s capabilities without disrupting the operations SAIF manages SaaS finances for all size of companies and know exactly what is needed at each stage (i.e. $ 1-3Mn, $3-5Mn, $5-10Mn ARR) and provides structured services accordingly well in time for smooth growth transition and not over/underselling from what is required.

You are a SAAS business and want your inhouse finance team to be equipped with the right tool kit and skills to leverage them?

Latest in SAIF world: SaaS, Ai & Finance

Choosing Between Chargebee and Stripe: Which Is Right for...

Read MoreUnderstanding Subscription Dunning: Definition, Best Practices, and More What...

Read More